Market implications

Inevitably, after such a violent and euphoric market move, investors will be questioning whether the rally can be sustained. Several factors suggest this rally could have some (short) legs.

- Technicals: Sentiment surveys and positioning had been very negative coming into Q4, suggesting the market was ripe for a technical rebound.

- Mid-term elections: Markets have rallied after the last 19 mid-term elections. Note, however, that this is likely to due to the clearing up of political uncertainty rather than anything else, and can only carry the market so far.

- China reopening: China has announced a loosening of certain COVID restrictions, reigniting hopes of a reopening with potentially significant implications for China’s economic recovery.

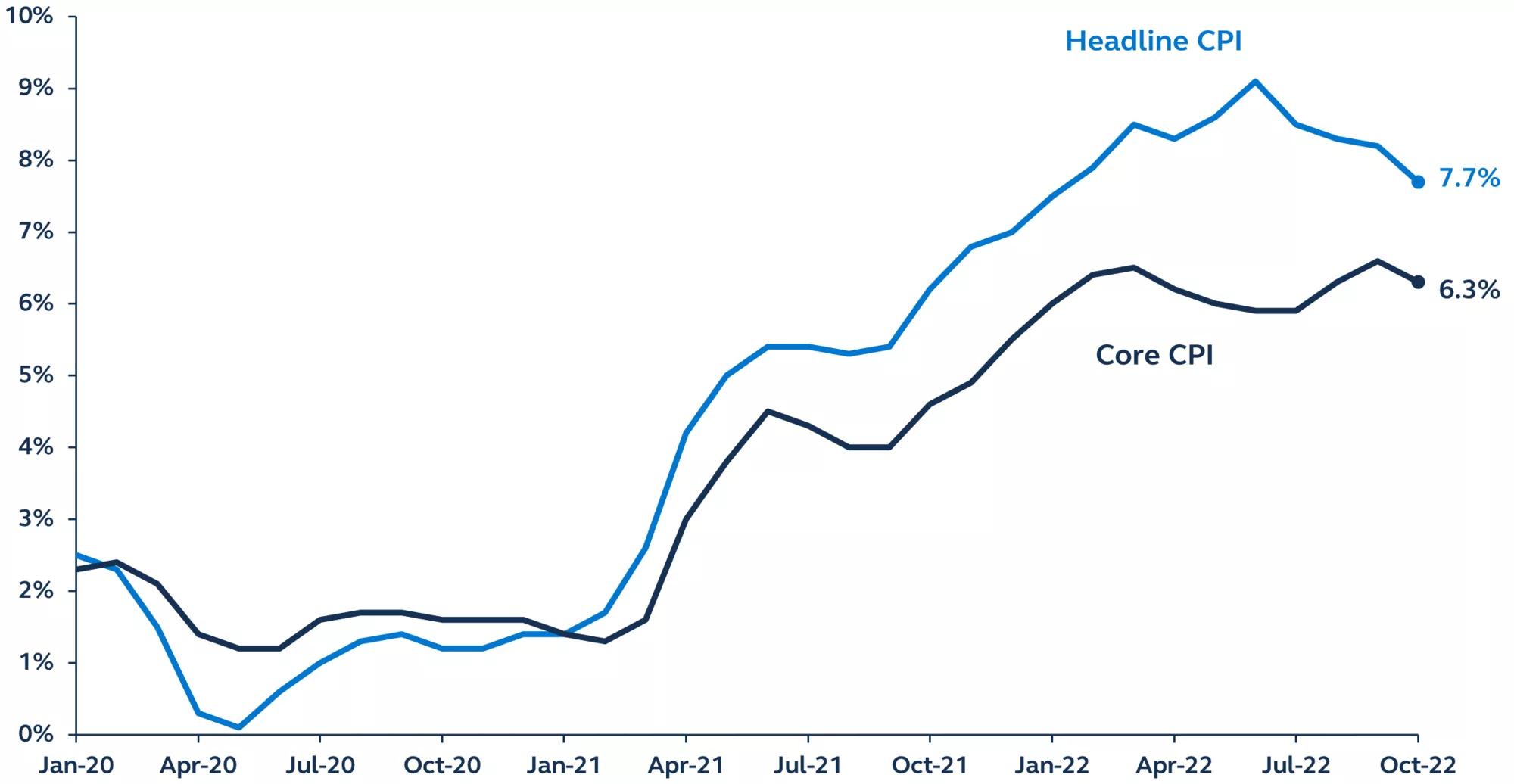

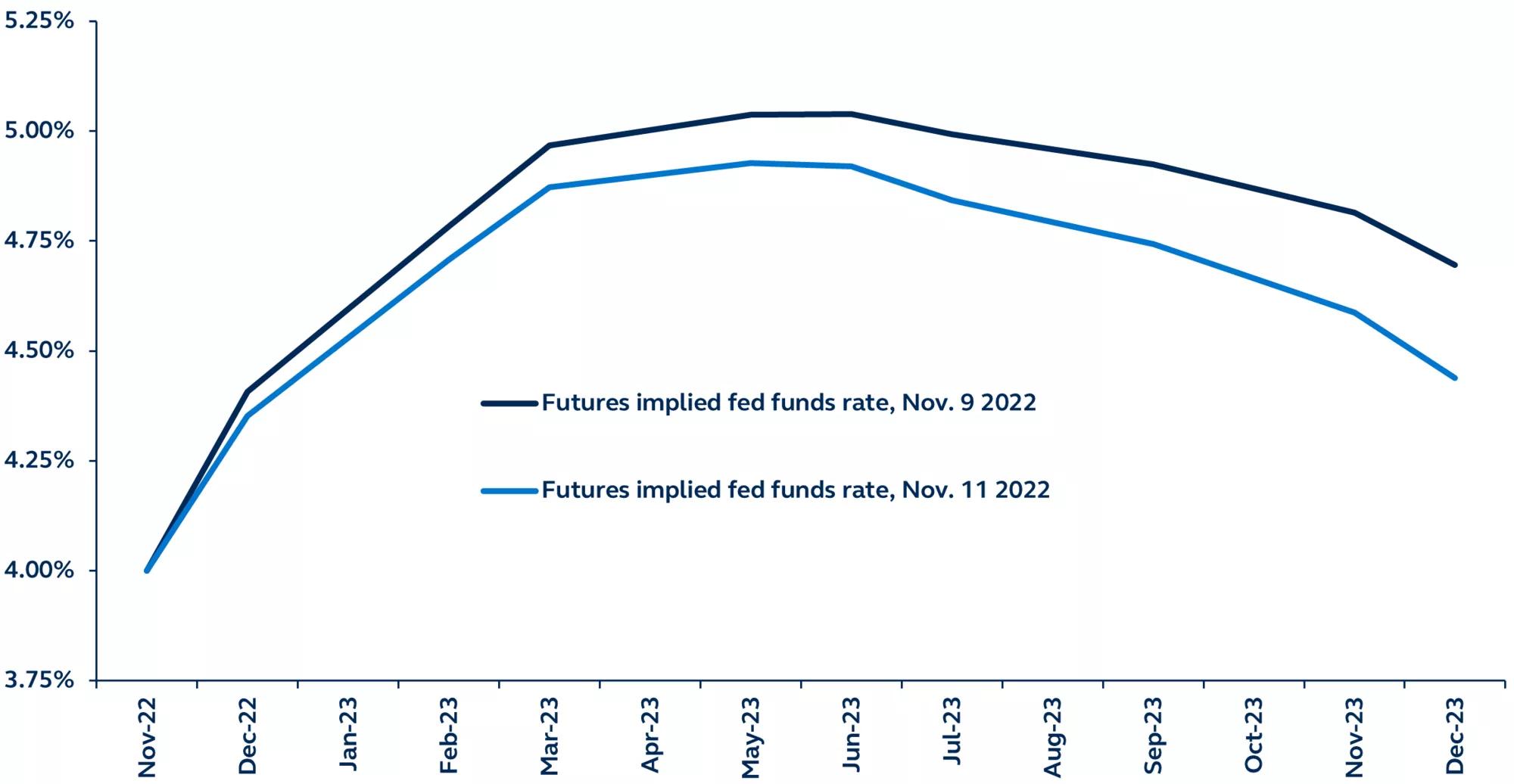

Unfortunately, however, the medium-term outlook for market weakness has not changed. Continued inflation caution and the prospect of further Fed hikes is laying the groundwork for U.S. recession in Q2 2023. Note that even amidst the optimism following the CPI report, the Fed’s preferred yield curve measure (forward rate spreads between 3-month borrowing rates and implied 3-months rates for 18 months’ time) for predicting recession plunged sharply into inversion territory yesterday.

Once technical factors and mid-term election relief are exhausted, risk assets will likely once again confront this challenging economic backdrop. Inevitably, after such significant market falls this year, there will be pockets of opportunities in the market—but these will need to be actively sought out by investors.