This morning, the Bureau of Labor Statistics released the highly anticipated Consumer Price Index (CPI) for February. While recent market events, namely the collapses of Silicon Valley Bank and Signature Bank, show that Federal Reserve (Fed) rate hikes have hit segments of the banking system hard, those hikes still haven’t had the desired effect on inflation. Annual headline CPI and core CPI eased to 6% and 5.5% respectively in February, in line with expectations, but monthly core CPI rose at its fastest pace in five months. A week ago, this inflation print may have cemented a 50 basis points hike at the next FOMC meeting. The events of the past week, however, are likely forcing the central bank’s priorities to shift toward financial stability. A 25 basis point hike—or even a pause in the Fed’s hiking cycle—are the most likely outcomes from the Fed’s meeting next week.

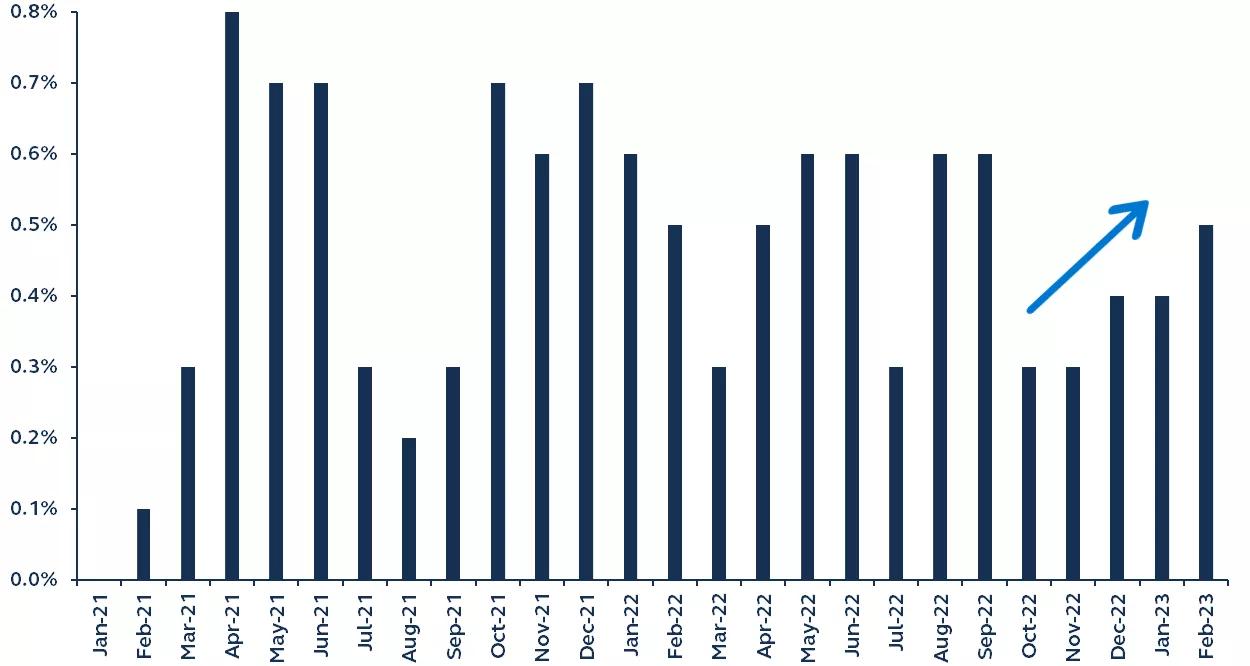

Monthly core CPI

Month-over-month change in core Consumer Price Index, January 2021–present

Source: Bureau of Labor Statistics. Principal Asset Management. Data as of March 14, 2023.

Report details

- Headline CPI rose 0.4% on the month, in line with expectations, bringing the annual rate down from 6.4% to 6%. Core CPI (which excludes the food and energy prices) increased 0.5% on the month, not only higher than the 0.4% consensus expectation, but also the fastest pace of increase in five months.

- The underlying components of the inflation report were concerning. Core goods disinflation, which had been driving the drop in price pressures in recent months, has faded and was unchanged in February. Leading indicators suggest core goods inflation may turn positive in the coming months—despite used car prices dropping sharply on the month, timelier survey data suggest a steep pick-up in in used car prices recently, which will likely feed through to official CPI data in a few months.

- Core services inflation accelerated in February, rising 0.6%. Shelter inflation was once again the main driver of the surge, rising 0.8%. While many economists expect shelter prices to begin to decline as the lagged effect of a slowing housing market filter through to new leases, progress is proving extremely slow.

- Core services ex-housing, a key focus for Fed Chair Jerome Powell, rose 0.5% month-on- month. This is the fastest pace of increase since September and certainly calls into question Powell’s previous comments that “disinflation is now underway.”

Outlook

February’s CPI report confirms that there is still a strong case for further aggressive Fed policy tightening. Yet now, with financial stability risks front of mind, the policy arithmetic of the Federal Reserve may have changed, and they will need to take extra consideration of the additional pressures further policy tightening could put on the financial system.

With still a week to go before the next FOMC meeting, policymakers have time to assess the situation and how it evolves. If risks settle down, the inflation situation as confirmed by today’s CPI release means that it would be prudent for the Fed to tighten policy by 25 bps. Yet, if financial stability concerns continue to grow, the Fed may have little choice but to pause. Ultimately, the stress that continually tightening monetary policy at such an aggressive pace is having on the real economy has finally underscored the tensions between the Fed’s efforts to tame inflation and growing concerns that further policy tightening will spark a recession.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results.

Views and opinions expressed are accurate as of the date of this communication and are subject to change without notice. This material may contain ‘forward-looking’ information that is not purely historical in nature and may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

Principal Asset Management leads global asset management at Principal.®

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2023, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

2791251