Our platforms in the U.S. and Europe provide a range of investment capabilities from traditional core strategies to opportunistic property development and redevelopment.

We are experienced in all areas of the private equity real estate market, including acquisitions, dispositions, asset management, and development.

We source and close a significant number of investments with strategies tailored to each client mandate. Our investors are comprised of a diverse array of defined benefit plans, defined contribution plans, high net worth and foreign clients.

Since 2001, leased over 590 million square feet across our portfolios and executed more than 33,000 leases.

In Europe we have deep experience across sectors benefiting from structural tailwinds such as logistics development, data centers, hotels, and care homes.

Our integrated investment process is driven by proprietary research and modeling of both the real estate market and the overall economy, demographics, local sub-markets, and property level considerations.

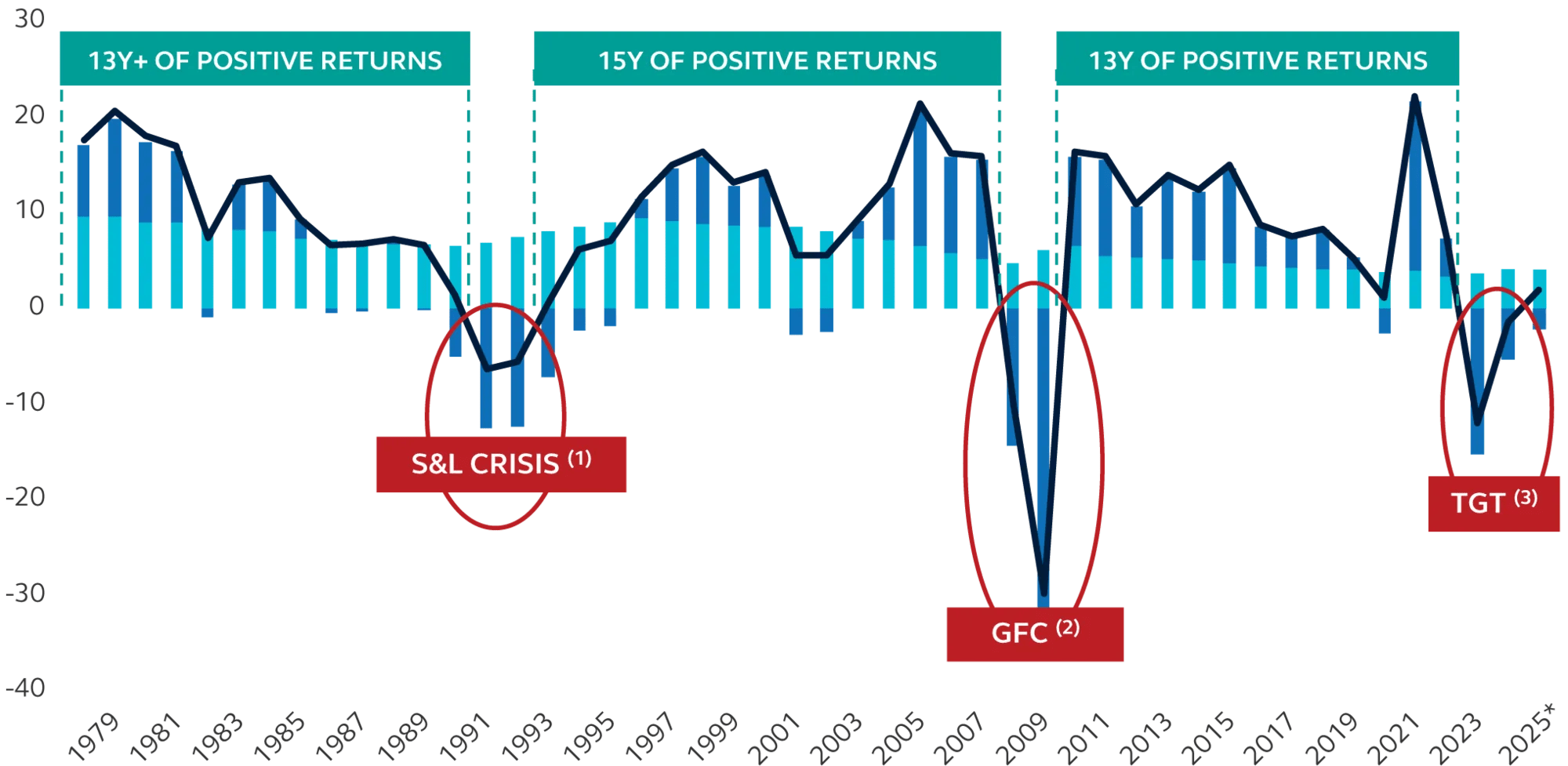

Today’s environment presents a compelling opportunity for private equity real estate investors. With most of the recent value correction behind us—barring a significant economic downturn—there is potential to invest at more attractive entry points. In a market still shaped by uncertainty, strategies that emphasize consistent income generation are particularly well-positioned. Commercial real estate has demonstrated remarkable resilience over time, delivering positive annual returns in 41 of the past 47 years, driven primarily by stable, income-based performance.

Historical performance—NCREIF annual returns

U.S. percentage, 1978-2025

- Income return

- Appreciation return

- NFI-ODCE

Our 360° view of global real estate gives us the insight needed to help you identify strategies that can offer compelling performance.

Data Centers

Diversify your portfolio and enhance potential for risk-adjusted returns by accessing an exciting sector experiencing unprecedented growth as a result of digital transformation and global demand for data.

European Hotels

Targeting areas of distress in the European hotel sector to unlock and create value.

U.S. Core-Plus Private Equity Real Estate

Combining the income-generating attributes of stabilized assets with higher, risk-adjusted returns available from value-added and development opportunities.

U.S. Core Private Equity Real Estate

Deploying a research-based allocation framework with in-depth coverage of more than 40 U.S. metropolitan real estate markets to invest in a diversified pool of high-quality, well-leased U.S. commercial real estate properties, including a long-standing allocation to alternative growing pool of niche property sectors.

Our experienced investment teams provide comprehensive, specialized, and sustainable capabilities across all four quadrants of commercial real estate—public equity, private equity, public debt, and private debt—as well as infrastructure investing. Whatever real estate strategy or combination of strategies you believe is right for your objectives, we can help.

Past performance does not guarantee future results.

Real estate investment options are subject to risks associated with credit, liquidity, interest rate fluctuation, adverse general and local economic conditions, and decreases in real estate values and occupancy rates.

Principal Real Estate is a trade name of Principal Real Estate Investors, LLC, an affiliate of Principal Global Investors.