Recent upside surprises

The past few months have been a particularly volatile period for Fed forecasts. As recently as early February, financial markets were convinced that the Fed would cut policy rates at least six times this year. Yet the hot January and February inflation and jobs reports prompted markets to significantly revise their expectations, bringing them in line with our own forecast for three cuts this year, starting in June.

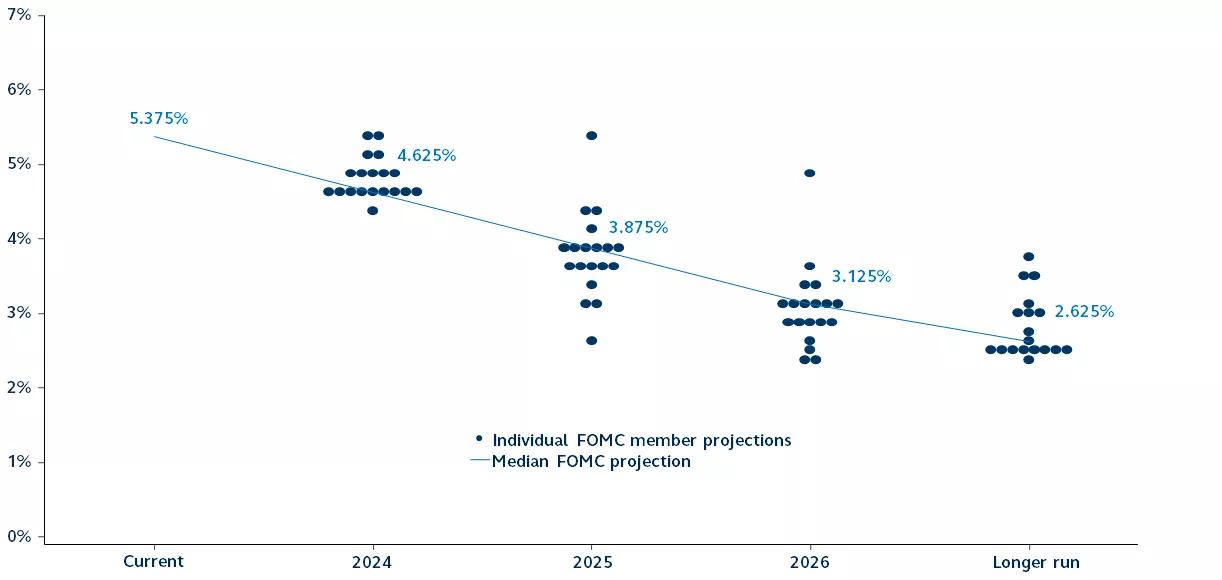

In the last week, there has been growing speculation that the latest inflation prints represented a setback to the Fed’s efforts to reach the 2% inflation target and, as such, the Fed’s dot plot may see one cut removed this year.

In fact, the Fed maintained its median forecast for three cuts this year, suggesting that the Fed believes the recent inflation prints may have potentially been distorted by seasonal effects and, as a result, the broader picture of disinflation has not changed.